Case Study #1: Could a Better Market Map Have Saved Jawbone’s B2B Pivot?

13 nov 2024

Overview

Jawbone, once a consumer tech favourite, saw wearables as its key to entering the healthcare and corporate wellness markets. However, without precise market segmentation, the company overestimated demand, misunderstood the nuances of clinical vs. non-clinical needs, and struggled to attract B2B clients. By 2017, it was clear: the pivot had failed, and Jawbone filed for bankruptcy!

The story is a prime example of why market mapping—accurately assessing your Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM)—is crucial. Jawbone saw potential in healthcare wearables but didn’t map out which sectors had realistic demand for its consumer-grade devices.

Lessons Learned

Understand Market Readiness: Just because a market is large doesn’t mean all segments are ready or willing to buy. Healthcare wearables in clinical settings demand more precision, reliability, and regulatory compliance than Jawbone’s devices offered.

Avoid “One-Size-Fits-All” Products: Corporate wellness programs have distinct needs from clinical healthcare providers. Jawbone’s general approach didn’t meet the specialised needs required for high adoption in either space.

Factor in Competitor Positioning: With established players like Fitbit already in corporate wellness, and companies with clinical expertise dominating healthcare, Jawbone’s SOM was limited from the start.

How Market Mapping Would Have Helped

If Jawbone had mapped its market more carefully, here’s what they might have discovered:

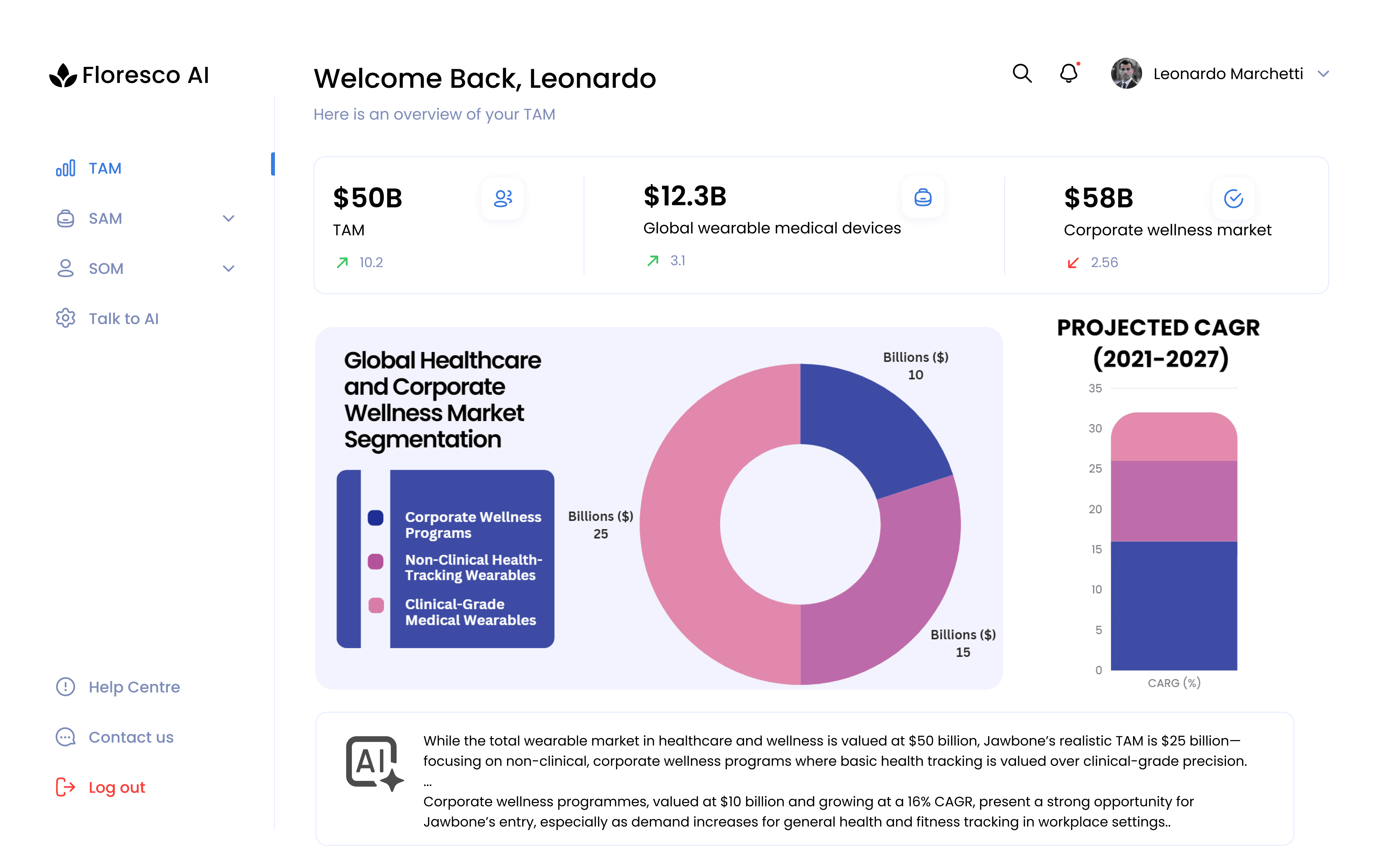

TAM Reality Check: The estimated TAM for wearables in the combined healthcare and wellness market is around $50 billion, but only about half aligns with general health tracking due to clinical requirements.

SAM Segmentation: Corporate wellness programs ($10 billion) offer a promising SAM for non-clinical devices, as they prioritise wellness over clinical-grade tracking.

SOM Limitations: Mapping the competitive landscape could have shown that Jawbone’s SOM in clinical healthcare would likely remain low due to product limitations, while corporate wellness held more potential for their current technology.

With a clearer roadmap, Jawbone could have focused its resources on the growing demand in corporate wellness programs and avoided the costly push into clinical markets.